October 1, 2021

Plan for Your

Retirement Nest Egg

Understanding your sources of retirement savings and income is important regardless of your age.

Saving for the future may not be top of mind when the present seems so uncertain. However, seeking financial security in retirement is a lifelong process that should include thoughtful, advance planning. Here are some things to consider.

Where are you currently?

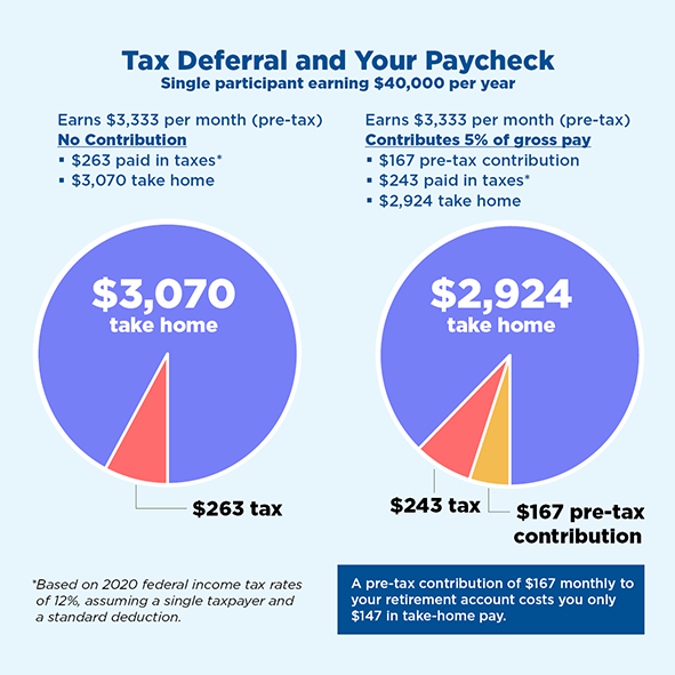

Make sure you’re saving the maximum amount that you can. If you are concerned about the dent that your retirement plan contributions may make in your paycheck, take a look at the chart below. It shows how making or increasing your current contributions can help you in two ways:

- By making contributions, you actually lower your current taxable income, so you will pay less income tax.1

- The money you contribute to your retirement plan isn’t taxed until you withdraw it; therefore your contributions grow, tax-deferred, giving your savings the opportunity to grow faster.2

The tax information contained herein is for informational purposes only. You should consult your tax adviser or attorney regarding your individual circumstances.

Do you have other sources of retirement savings or income?

In addition to your employer-sponsored retirement plan, do you have other savings, such as from a part-time job or freelance work? If you do not already have an IRA, consider taking advantage of this tax-deferred way of saving by opening a Mutual of America IRA, a variable annuity contract. And, Social Security is another source of retirement income. You can check your projected Social Security benefits at socialsecurity.gov/estimator/. The bottom line is to keep track of all sources of savings and income.

Have you developed a financial roadmap?

Once you know your sources of retirement savings and income, our Retirement Nest Egg Calculator helps you to estimate what you may need to save to support the standard of living you want in retirement. This and our other Retirement Calculators can help you model customized retirement saving and income scenarios based on your own specific personal and financial circumstances and retirement goals.

If you have questions, and to learn more about your retirement saving options, please call your local Mutual of America representative today.

1Tax-deductible contributions apply to traditional retirement savings plans only. Roth contributions, if permitted under your plan, are made on an after tax basis and grow on a tax-free, rather than a tax-deferred, basis.

2Withdrawals are subject to income tax at your ordinary income tax rate at the time of withdrawal, and if made prior to age 59½, a 10% federal tax penalty.

Information and interactive calculators are made available to you as self-help tools for your independent use and are not intended to provide investment advice. We cannot and do not guarantee their applicability or accuracy in regard to your individual circumstances. All examples are hypothetical and are for illustrative purposes only. We encourage you to seek personalized advice from qualified professionals regarding all personal finance issues.