October 1, 2021

Benefits of Consolidating

Retirement Assets

Consider streamlining your retirement assets into your employer-sponsored retirement plan.

Consolidating your retirement savings is a simple and efficient way to take control of your finances, especially during these uncertain times. If you have multiple retirement accounts—such as a 401(k) or 403(b) plan with a former employer, or an Individual Retirement Account (IRA) at another financial institution—rolling over your balances into a single account at Mutual of America could make managing your money easier. Regardless of what stage you’re at in your retirement journey, following are some advantages of having all of your retirement assets held in one account:

1. Convenience.

Simplifying your recordkeeping by viewing all of your retirement savings on a single website or statement showing the full picture of your funds can make keeping track of them more convenient.

2. Ease.

Managing your retirement assets, reviewing their performance and mapping out your investment goals can be more efficient when all of your assets are in one account.

3.Cost-effectiveness.

Having all of your assets in one retirement account instead of different accounts may save you money on account management and maintenance fees. (Keep in mind that rollovers are tax-free.)*

4. Local service.

In addition to accessing your account in one place, you can meet online or in person with your local Mutual of America representative to review your account and get answers to questions you may have.

Consider taking charge of your financial planning by consolidating all of your retirement assets in one place—contact your local Mutual of America representative today.

Before making a transfer, you should review the accounts you have with other providers to determine the fees and expenses you currently pay and whether there are any surrender charges that may result and to ensure that it is in your best interest to transfer your other accounts to your current plan.

* Withdrawals are subject to income tax at your ordinary income tax rate at the time of withdrawal, and if made prior to age 59½, a 10% federal tax penalty.

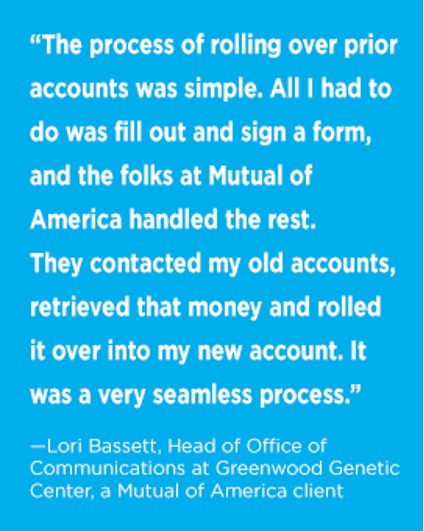

Statements made in this publication by a client of Mutual of America are not paid testimonials. These testimonials may not be representative of the experience of other clients and are not indicative of future performance or success.