October 1, 2021

Prioritize Your Future

Three tips to help women focus on their financial needs.

Saving for the future, regardless of your age and gender, can be challenging. For working women juggling multiple responsibilities, this may also include focusing on others’ wants and needs while putting their own financial future on the back burner. If this sounds similar to your experience, there are some things you can do in addition to saving in your employer-sponsored retirement plan so that your needs—including planning for a more financially secure future—are not put aside.

“As far as women saving for retirement, I had a very strong role model with my mother,” says Lori Bassett, Head of the Office of Communications at Greenwood Genetic Center, a Mutual of America client. “[She] was very passionate about saving when she was working, and now is enjoying a very comfortable retirement. So, she was a great influence on me.”

Here are three tips to consider:

1. Develop a plan.

A good starting point is to write down your income, expenses and savings and long-term goals. Put yourself first during this assessment, and ask if your financial habits help facilitate your aspirations. If not, write a plan to help guide you toward saving more and spending less. You can utilize budgeting worksheets like this one1 to get started. And when thinking about your long-term financial goals, be sure to consider your personal circumstances, risk tolerance, time horizon and complete financial situation.

2. Find additional sources of income.

Maximizing your sources of recurring income is another way to help cover your basic living expenses. Since women tend to have a longer life expectancy than men, this is especially crucial.2 One way to increase income in addition to a full-time job is through freelance work—for example, consider transforming a passion into a business, such as selling your paintings, photos or crafts, or writing articles for various publications.

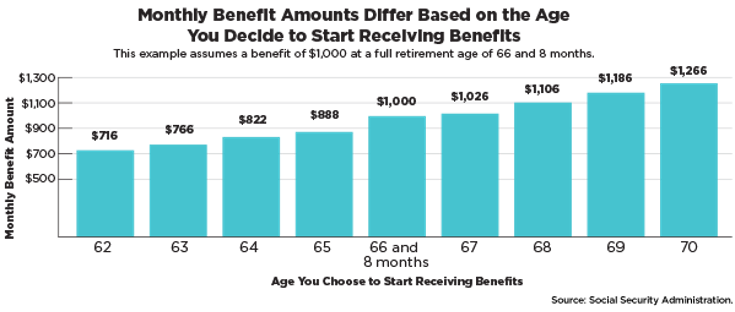

3. Be strategic about your Social Security benefit.

If you’re nearing retirement, consider delaying your Social Security benefit—the amount you would receive at your full retirement age—even by a few years, to increase the amount of income you can receive. Although you can start your retirement benefit at any point from age 62 up until age 70, the chart shows how your benefit will be higher the longer you delay starting it.3 You can get an idea of how much of a boost you might get by using the Social Security Early or Late Retirement Calculator.4

To learn more, please contact your local Mutual of America representative today.

1Federal Trade Commission, https://www.consumer.ftc.gov/articles/pdf-1020-make-budget-worksheet.pdf.

2Social Security Administration, tps://www.ssa.gov/OACT/population/longevity.html.

3Social Security Administration, https://www.ssa.gov/pubs/EN-05-10147.pdf.

4Social Security Administration, https://www.ssa.gov/oact/quickcalc/early_late.html.

Statements made in this publication by a client of Mutual of America are not paid testimonials. These testimonials may not be representative of the experience of other clients and are not indicative of future performance or success.