July 1, 2021

Basics of Enrolling in a

Retirement Plan

Starting your career? Here are answers to some questions you may have about saving for retirement.

Finding your professional and financial footing once you begin your career is a process with many moving parts. Whether you’ve just finished college or graduate school, you may be wondering how it’s possible to save for the future when there are so many more immediate concerns—from rent to groceries and healthcare—that require spending money. Here are answers to some questions that can help as you look to the future.

Should I wait until I’m financially ready to contribute to a retirement plan?

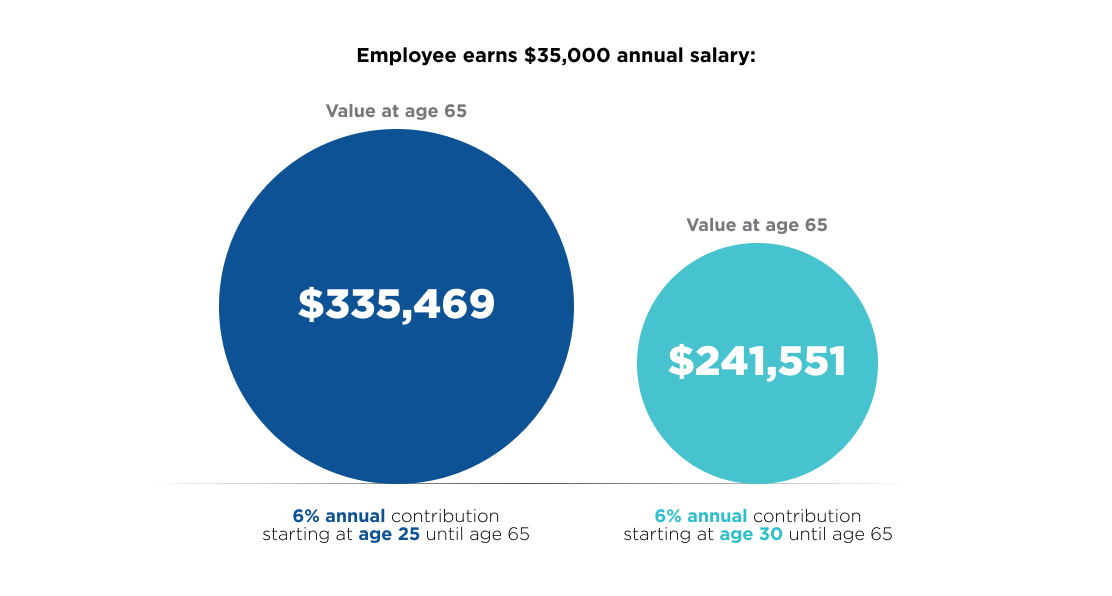

Assuming your employer offers a retirement plan, and you’re eligible to enroll and contribute, then you probably are financially ready. The earlier you start saving, the more time your savings have to grow. For example, a 25-year-old with no prior retirement savings who earns a salary of $35,000 and contributes 6% annually to their workplace retirement plan ($2,100 a year, or less than $100 per paycheck) could have $335,469 at age 65, assuming a 6% annual rate of return. But if that 25-year-old waited until age 30 to begin contributing, they would have $241,551—almost $100,000 less in retirement savings—at age 65.

This hypothetical example is for illustrative purposes only and does not represent any actual investment performance, price or yield. This illustration assumes an annual salary of $35,000, a beginning balance of $0, an annual retirement plan contribution of 6% ($2,100) and no increase in earnings. The illustration uses an annual rate of return of 6%. Investment returns are not guaranteed, and your actual return may vary significantly from that shown. All investments involve risks, including possible loss of principal.

What are some benefits of a retirement plan?

An employer-sponsored retirement plan is a great way to build savings for your future. Not only can you make contributions through automatic payroll deduction, some employers will even match their employees’ contributions up to a certain amount (see below), and earnings on your contributions are not immediately taxed.* Plus, the quicker you get started, the better. Through the power of compounding, regularly contributing to your retirement savings for as long as you can gives you the best chance to meet your retirement objectives.

How much should I contribute to a retirement plan?

Once you enroll in a retirement plan, contribute as much as you’re able up to the annual limits. If your retirement plan offers an employer match, take advantage of it. This means your employer will match a certain percentage of whatever you contribute, up to a specific level. If you need to start off with smaller contributions, you can always gradually increase the percentage you contribute. Even a 1% annual increase can make a difference over time.

To learn more about your retirement plan, contact your local Mutual of America representative today.

*If contributions are made on a pretax basis, withdrawals are subject to income tax at your ordinary income tax rate at the time of withdrawal and, if made prior to age 59½, may be subject to a 10% federal tax penalty. If contributions are made on an after-tax basis to a designated Roth account, qualified distributions are tax-free.