October 1, 2021

The Cost of

Waiting to Save

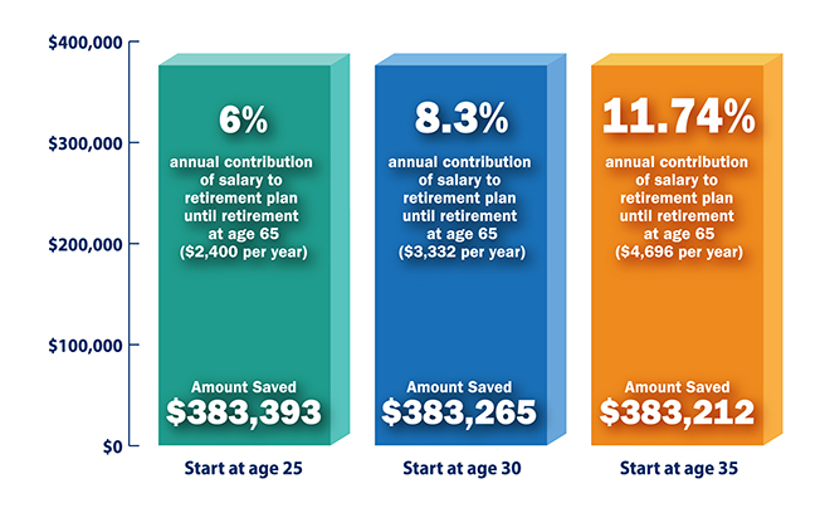

Long-term goals like retirement can seem far off when you’re in your 20s and early 30s, especially if you’re juggling competing demands on your money, such as paying down school loans or setting aside money for vacation. Yet, delaying saving for retirement, even by five or ten years, can be costly in the long run.

The reason is simple: making up for lost time isn’t easy. The hypothetical illustration below highlights how the earlier you begin contributing to your employer-sponsored retirement plan, the more time your savings have to grow, and the less you may have to play catch-up just to reach your retirement savings target. For example, a 25-year-old with an annual salary of $40,000 could contribute about half the amount of money each year ($2,400), compared to a 35-year-old ($4,696) earning the same salary, and still save approximately the same amount by age 65, assuming the same rate of return.

If you started saving for retirement early through regular contributions, that’s great, keep building your nest egg! And if you didn’t, resolve to take action now. To learn more, call your local Mutual of America Regional Office representative today.