August 25, 2021

Spend and Save:

Find the Right Balance

Three tips to consider when juggling current expenses and saving for your financial future.

This summer, many individuals are making the most of renewed opportunities to get out and explore, as well as to spend time with friends and family. Of course, this increase in activity likely means an increase in expenses that comes with eating out more often, traveling and getting back to enjoying some favorite activities. While these activities may be vital for your mental wellness, it’s also important to pay attention to your financial wellness and make sure you’re striking the right balance between spending today and saving for tomorrow. Here are three tips to consider:

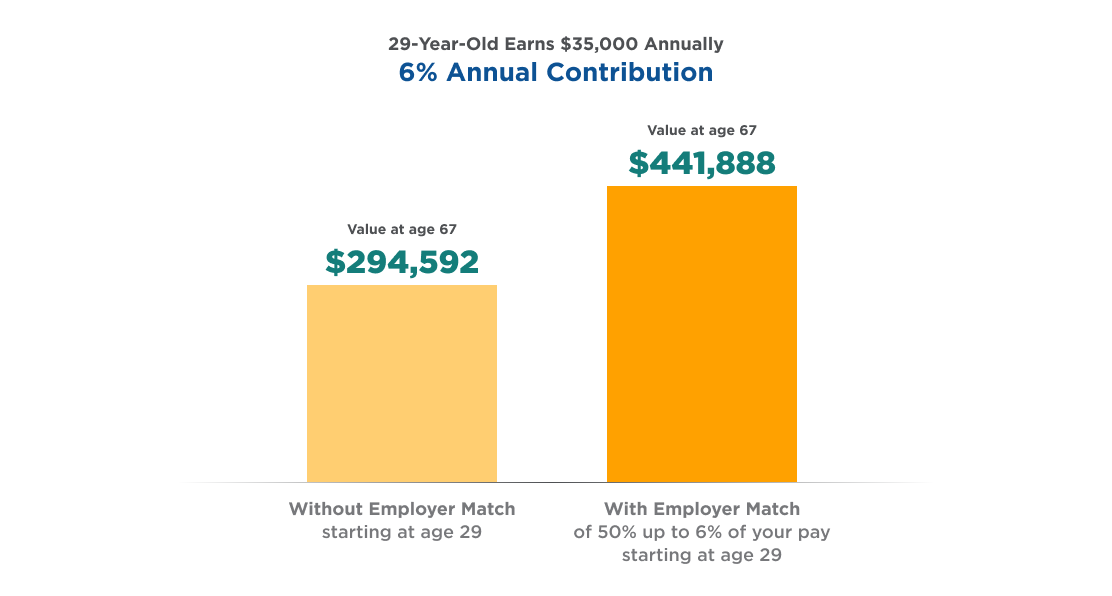

- Recalibrate retirement contributions as needed. Check how much you’re contributing to your retirement plan. At a minimum, if your employer offers a match, be sure to take full advantage of it. Over time, the benefit can be significant, as the chart below shows. For example, assume you earn $35,000 a year and contribute 6% of your salary ($2,100) annually. Also assume that your employer offers a match of 50% of your contributions up to 6% of your annual pay—which provides $1,050 more in tax-deferred contributions going directly into your plan each year. That’s like getting a raise just for saving for retirement

This hypothetical example is for illustrative purposes only and does not represent any actual investment performance, price or yield. This illustration assumes a beginning balance of $0, assumes no increase in earnings and has an annual rate of return of 6%. Investment returns are not guaranteed, and your actual return may vary significantly from that shown.

- Gradually build your savings. When it comes to short- and long-term saving, starting small can make a big difference. For example, our 52-Week Savings Challenge highlights how putting away even small amounts of money can add up over time and help you generate a cushion for those inevitable unexpected emergencies. As for long-term saving, keep in mind that an increase in your contribution rate of even one or two percent per paycheck can make a meaningful difference over time. Our Retirement Savings Calculator can help you see the effect of your monthly contributions and employer match on your total retirement savings.

- Keep track of spending. Think about ways to reduce your spending on nonessential items that you may want but don’t necessarily need. Keep in mind, you don’t have to give up every little thing in your day that brings you joy! Just choose your nonessential spending wisely so it doesn’t negatively impact your ability to keep on track with your long-term savings goals. Easy-to-use budgeting worksheets, like those available at mymoney.gov, can help you track your monthly expenses and purchases, and compare them to your take-home pay and other income.

If you have questions or want to learn more, contact your local Mutual of America representative.

Information and interactive calculators are made available as self-help tools for independent use and are not intended to provide investment advice. We cannot and do not guarantee their applicability or accuracy in regard to individual circumstances. All examples are hypothetical and are for illustrative purposes only. We encourage individuals to seek personalized advice from qualified professionals regarding all personal finance issues.