May 2, 2023

Know the difference between

stocks and bonds?

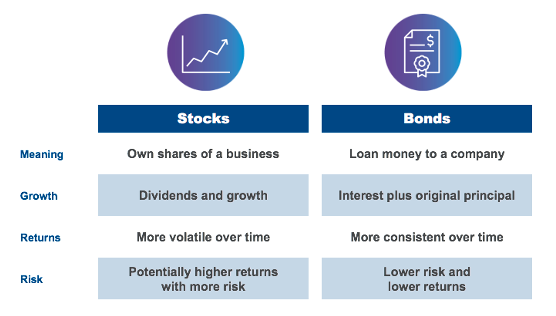

Stocks and bonds are two terms you may have heard associated with your workplace retirement account. Stocks are made up of units called “shares.” When you buy a stock, you become a part-owner of that company through the “shares” you buy. This means you have equity in the company.

When you buy bonds, it’s like lending a company money. The company then pays you interest over time, and promises to repay the original amount of the loan, or principal, at maturity—usually longer than 10 years.1 That’s how you make money.

Key features

Stocks are historically more volatile investments than bonds, but they have the potential to provide greater returns over the long term.

Bonds are generally considered lower-risk investments, but they offer lower returns. Investing in bonds still involves risk. Bond prices generally fall when interest rates rise.

Categories of stocks

Stocks are generally categorized by the size of the company and its market capitalization. Market capitalization refers to the value of a publicly traded company’s shares of stock.2

Here is a quick look at three common types of stock:

Small cap: These tend to be issued by young, potentially fast-growing companies.3

Mid cap: These tend to be bought by investors for their growth potential.4

Large cap: These are generally considered less volatile than stock in smaller companies, in part because the bigger companies may have larger reserves to carry them through economic downturns.5

Saving for retirement is a journey, and it’s never too early to boost your investment knowledge. If you have any questions or want to learn more about your retirement saving options, please reach out to your Mutual of America representative.

1 https://www.mutualofamerica.com/insights-and-tools/glossary/?newLetter=B

2 https://www.investor.gov/introduction-investing/investing-basics/glossary/market-capitalization

3 https://www.mutualofamerica.com/insights-and-tools/glossary/?newLetter=S

4 https://www.mutualofamerica.com/insights-and-tools/glossary/?newLetter=M

5 https://www.mutualofamerica.com/insights-and-tools/glossary/?newLetter=L