April 27, 2022

Economic & Market Perspective: April 2022

By Stephen Rich

During the first quarter of 2022, the combination of inflation at multidecade highs, the U.S. Federal Reserve beginning to tighten monetary policy by raising interest rates, the war between Russia and Ukraine, and the lingering impact of the global pandemic resulted in a historically turbulent period both for stock and bond investors.

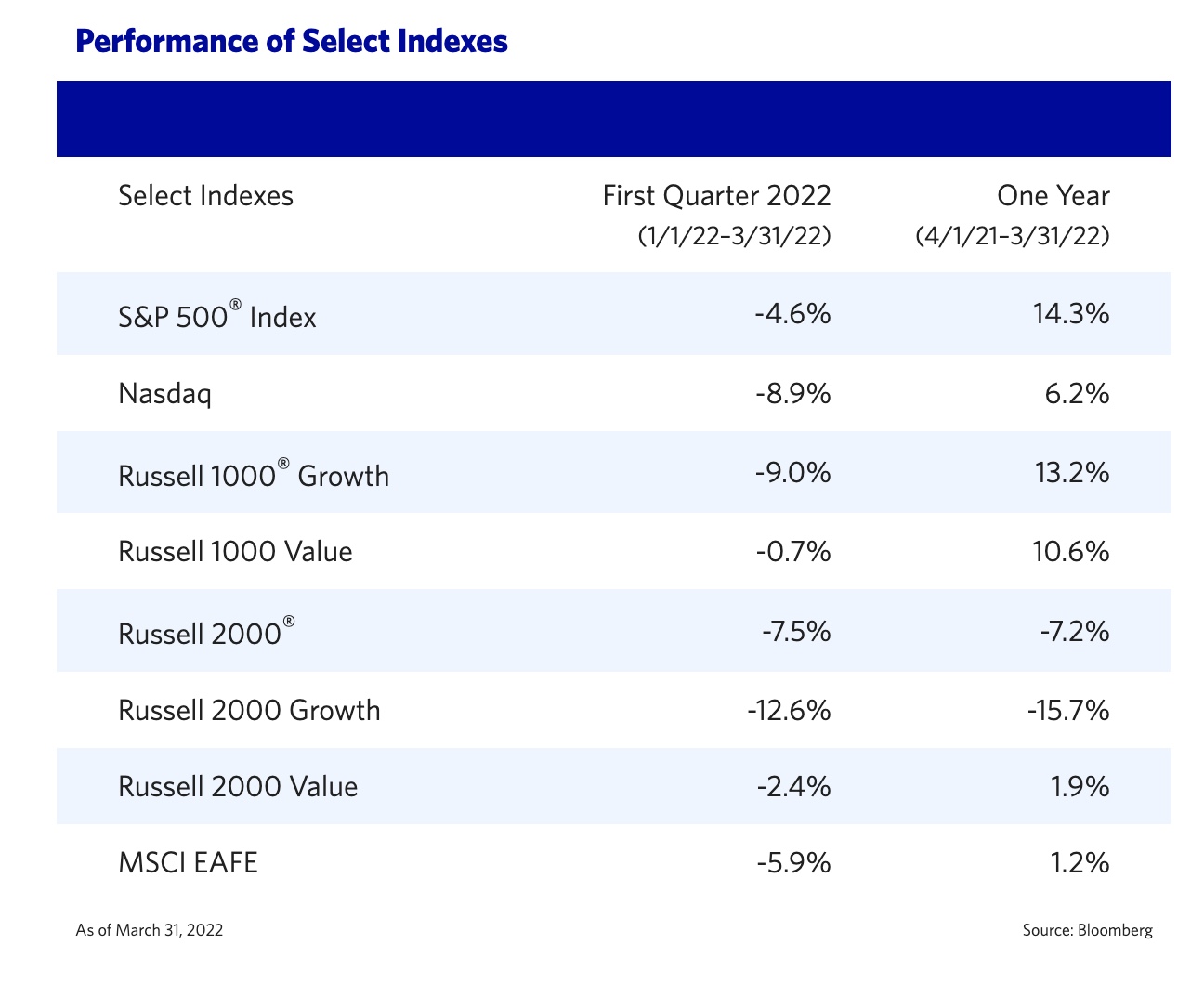

On the equity side, the S&P 500® Index declined 4.6%, the Nasdaq slumped 8.9% and the Dow Jones Industrial Average fell 4.1%. On the fixed-income side, returns were just as disappointing, as the Bloomberg U.S. Corporate Bond Index declined 7.7% and the Bloomberg U.S. Aggregate Bond Index fell 5.9%. One bright spot in the financial markets for investors was in the commodities sector, which soared in response to anticipated supply disruptions and global inflation pressures. For example, the prices of oil, copper and wheat all rose, and the Bloomberg Commodity Index returned 28%, its best quarterly gain since 1990.

As we move through the first half of the year, Mutual of America Capital Management LLC continues to see volatility both in equities and bonds as uncertainty surrounds the consequences and outcome of the war in Ukraine and the ability of the Fed to tame inflation by raising interest rates without tipping the economy into recession.

Equities on Rollercoaster Ride

In the first quarter, the Russell 1000® Value Index (down 0.7%) outperformed the Russell 1000 Growth Index (down 9.0) by 8.3%. Given that higher interest rates make future earnings less valuable, it was not surprising to see the value sector outperform the growth sector among large cap and small cap equities.

Bond Prices Under Pressure, Too

Interest rates have been on a downward trend since the early 1980s, meaning that bond prices have been in a prolonged bull market. This decades-long rally was supercharged by the massive central bank response in 2020, due to the pandemic’s economic toll when rates fell to record lows. Since the pandemic started receding, however, bonds have come under increasing pressure as inflation began working its way into the financial system. As such, inflation pressures are much broader and more serious than they were at this time last year. In December of 2021, the Fed changed its narrative and openly stated that inflation was not going to be as transitory as it had originally thought. On March 16, the Fed approved a 0.25 percentage point rate hike, the first increase since December 2018.

During the first quarter of this year, the 10-year Treasury rose 82.8 basis points, to 2.34%, after finishing 2021 at 1.51%. Additionally, the two-year Treasury surpassed the 10-year Treasury, marking a so-called inversion of the yield curve, something not seen since 2019. Inverted yield curves have preceded most recessions in the past, and the latest yield moves have stirred debate among investors and economists over whether the economy may be headed into a recession. With interest rates rising aggressively, bond prices fell during the quarter. The 10-year Treasury was down 6.7%, the 30-year Treasury declined 11.4%, the Bloomberg U.S. Corporate Bond Index fell 7.7% and the Bloomberg U.S. Aggregate Index declined 5.9%. Although this data reflects just the first three months of 2022, it’s worth noting that bonds finished 2021 with a negative return and that it’s extremely unusual for bonds to have negative returns in back-to-back years. In fact, the last time that happened was in 1956.

Inflation Is No Longer Transitory

Taking a closer look at inflation, it continues to be problematic in the U.S., and its persistent rise is being caused by a variety of factors, including increases in global commodities, rising consumer demand, wage pressures and supply-chain bottlenecks. All three well-known inflation gauges showed heightened and increasing levels well above the Fed’s average target of 2.0%: 1) the Bureau of Economic Affairs’ Personal Consumption Expenditures (PCE), the Fed’s preferred inflation gauge, was up 6.4% year over year; 2) the Producer Price Index, which sometimes predicts the direction of consumer prices, was up 11.2%; and 3) the Consumer Price Index (CPI), the most widely recognized gauge, was up 8.5%—its highest level since June of 1982. The CPI provides a statistical measure of the average change in prices in a fixed market basket of consumer goods and services. The March CPI came in at 8.5%, marking the 13th consecutive month that inflation was above the Fed’s target rate.

Consumers Feeling Inflation’s Impact

The ongoing effect of inflation has directly impacted consumers’ purchasing power. Gas prices continued to climb nationwide during 2022, with a national average of $4.33 per gallon on March 28, 2022. Just a year ago, the national average was $2.94. In many states, the current price is at all-time highs. Under pressure to provide some relief to U.S. consumers, the Biden administration announced on March 31 that the U.S. would release one million barrels of oil per day from the Strategic Petroleum Reserve in an effort to help cut gas prices and fight inflation. Food prices also continue to rise. The U.S. Department of Agriculture’s (USDA) Economic Research Service updated its March report, predicting a 4.5%–5% rise overall in food prices this year. The report stated that the cost of eating out is expected to show the highest increases, at 5.5%–6.5%. The most recent Standard & Poor’s CoreLogic Case–Shiller Home Price Indices, from December 2021, reported a 19.1% annual gain. While down slightly from the 19.7% peak in September 2021, these are very strong numbers that will continue to keep the CPI elevated in the coming months.

Commodity Prices Surging

At the start of 2022, commodity prices were already elevated; however, the war in Ukraine exacerbated the problem. With fears of potential supply disruption in the oil markets due to the ongoing war, crude prices surged above $100 per barrel for the first time since 2014. While sanctions originally placed on Russia by the West did not specifically target Russia’s oil and gas producers, buyers of Russian energy products struggled to secure guarantees at Western banks and find ships to deliver these products. Russia is the world’s second-largest producer of crude products and provides about 35% of Europe’s natural gas supply (including 50% of Germany’s supply). Russia is also the world’s second-largest producer (after Canada) of fertilizer, a key nutrient used on major commodity crops and produce.

With this in mind, farmers in the U.S. are bracing for a hike in the price of fertilizer, which was already at a record-high before the conflict. According to American Farm Bureau Federation and USDA data, fertilizer is expected to jump 12% this year, after rising 17% last year. If American farmers decide to use less fertilizer, that could curb yields for the fall harvest at a time when the world may need greater supplies of grain. In addition, prices of the following major commodities significantly rose in the 12-month period ending March 31, 2022: aluminum (+58%); nickel (+100%); coffee (+89%); corn (+33%); wheat (+68%); sugar (+31%); and cotton (+76%). All of these are major inputs in the products Americans use every day, and consumers will continue to feel the pain of these increases as manufacturers pass the costs along in the form of higher prices.

A Hawkish Federal Reserve Has Emerged

Faced with this commodity-driven inflation spike, the Fed is now headed for its most aggressive monetary policy tightening in almost three decades. During a press conference on April 5, 2022, Federal Reserve Governor Lael Brainard said the Fed “will continue tightening monetary policy methodically through a series of interest rate increases and by starting to reduce the balance sheet at a rapid pace as soon as our May meeting.” She also made it clear that, “given that the recovery has been considerably stronger and faster than in the previous cycle,” the $8.5 trillion balance sheet will be reduced at a faster pace than when the Fed attempted the last quantitative tightening (QT) in 2017 and 2018. A day later, the Fed announced that it would begin to reduce its massive bond holdings at a pace of as much as $95 billion a month to further tighten credit, at the same time that it is raising interest rates in an effort to cool the economy. The $95 billion a month is nearly double the peak rate of $50 billion the last time the Fed trimmed its balance sheet.

At the current time, the financial markets are anticipating cumulative rate hikes of 2.25% points, on top of the 0.25% increase already delivered by the Fed in March. The Fed has not done this much tightening—2.50%—in one year since 1994, a terrible year for the bond market that even included a 0.75% point hike. The financial markets are now expecting a 0.50% rate hike in May, which would be the largest rate increase since 2000. With inflation (as measured by the CPI) heading for more than 8%—a rate not seen in 40 years—Fed officials have adopted a decidedly more hawkish tone.

Strong Consumer and Tight Labor Markets Lower Recession Risk

The Fed clearly has an enormous task ahead to reduce inflation without making a policy mistake. Recently, Fed Chairman Jerome Powell said the economy was “very strong and well positioned to handle tighter monetary policy.” The business cycle is still on solid ground, with the Conference Board’s Leading Economic Index® (LEI) for the U.S. up 7.6% year over year in its most recent reading. The positive news is that, in addition to a strong economy and tight labor market, U.S. consumers have accumulated excess savings to help manage against rising prices.

A tight labor market should make it harder for the economy to spiral into a recession. This has the potential to give the Fed some breathing room as it embarks on its tightening cycle with the hope of guiding the economy to a soft landing that avoids a recession. In the first quarter, the labor markets continued to report job growth as they did in 2021. In March, nonfarm payrolls increased by 431,000. There were also positive revisions to previously reported numbers for January and February, indicating that the job market is performing well. The most recent Bureau of Labor Statistics (BLS) survey also showed that workers are rejoining the labor force at a rapid pace. March’s participation rate rose to 62.4% (the rate was at 60.2% in April of 2020) and is almost back to its 63.4% rate measured in January and February of 2020. Moreover, by the end of March, the unemployment rate hit a new pandemic low of 3.6%, which is just above the pre-pandemic level (and 50-year low) of 3.5% in March of 2020. If activity remains on track, unemployment is likely to fall below the pre-pandemic levels to rates not seen since 1953. Looking at the BLS’s Job Openings and Labor Turnover Survey (JOLTS) for January showed that the number of job openings nationwide was 11.26 million. This is an indication that the labor market is tight, with a greater supply of jobs than demand for jobs.

Equity Valuations

2021 was the most profitable year for American companies since 1950. In 2022, profit growth is expected to slow to roughly 9% in the fiscal year 2022, down significantly from the 2021 fiscal year’s growth of 46%. Additionally, as the Fed tightens monetary policy, profit margins are likely to start to deteriorate. Most macroeconomists estimate that the S&P 500 will earn $228 a share in 2022. Currently, the S&P 500 trades at a forward price-to-earnings (P/E) multiple of 19.7, which is elevated relative to the historic range of 14 to 15 times for forward multiples. After a rough start to the year, the S&P 500 has quietly climbed back to within 4% of its record, set on January 3, 2022. The S&P 500 finished up 1% or greater on nine trading days during March. Many strategists continue to believe the U.S. stock market is still the best place to invest, given the outlook in other regions of the world. As the popular adage goes: There Is No Alternative (TINA). Still, some strategists insist the recent rebound is just a bear market rally. Either way, volatility is likely to continue as a result of decelerating earnings growth, high valuations and an interest-rate tightening cycle.

Outlook

While the financial markets navigated through a significant downward swing during the first quarter of 2022 before experiencing a late rebound, there are a number of issues impacting the markets and economy worth keeping an eye on through the first half of this year. On the positive side, the country continues to see strong jobs growth, near-record-low unemployment rates, robust corporate earnings, healthy consumer spending from excess savings, and still relatively low interest rates. On the negative side, inflation continues to rise to levels not seen in decades, as supply-chain disruptions persist and war between Russia and Ukraine intensifies. Further, rising prices for food and commodities (such as gas), as well as the Federal Reserve’s start of interest rate hikes, continue to affect consumers’ purchasing power.

With all of this in mind, the Fed clearly recognizes that inflation is a major problem and is expected to use all of the tools in its arsenal to cool the economy, engineer a soft landing and avoid a recession. While the COVID-19 Omicron variant is largely diminished, increases in cases of the BA.2 variant have created some uncertainty about future economic disruptions. For now, however, economic growth has returned to pre-pandemic levels, which should allow the Fed to focus on fighting inflation. Volatility in the stock and bond markets is likely to continue as long as these issues remain. Among stocks, especially the top names in the S&P 500, valuations remain potentially stretched. With this in mind, we continue to favor value-oriented stocks, especially as interest rates rise during the year. We will continue to monitor these issues and other events that might impact our outlook in the coming months.

Stephen Rich is the Chairman and CEO of Mutual of America Capital Management LLC.

Past performance is no guarantee of future results. The index returns discussed above are for illustrative purposes only and do not represent the performance of any investment or group of investments. Indexes are unmanaged and not subject to fees or expenses. The index returns above reflect the reinvestment of distributions. It is not possible to invest directly in an index.

The views expressed in this article are subject to change at any time based on market and other conditions and should not be construed as a recommendation. This article contains forward-looking statements, which speak only as of the date they were made and involve risks and uncertainties that could cause actual results to differ materially from those expressed herein. Readers are cautioned not to rely on our forward-looking statements.

Mutual of America Capital Management LLC is an indirect, wholly owned subsidiary of Mutual of America Life Insurance Company. Securities offered by Mutual of America Securities LLC, Member FINRA/SIPC. Insurance products are issued by Mutual of America Life Insurance Company.