June 18, 2021

Start Now, Save More

Saving even just a little today can lead to greater savings tomorrow.

If retirement is a long way off for you, and you’re thinking of delaying saving, remember that such a decision could prove costly. Between a pandemic and economic uncertainty across the country, it’s precisely for times like these that we plan for tomorrow. Saving money for your retirement now—even in small amounts—could lead to greater savings than trying to catch up in later years.

Here’s a scenario as an example:

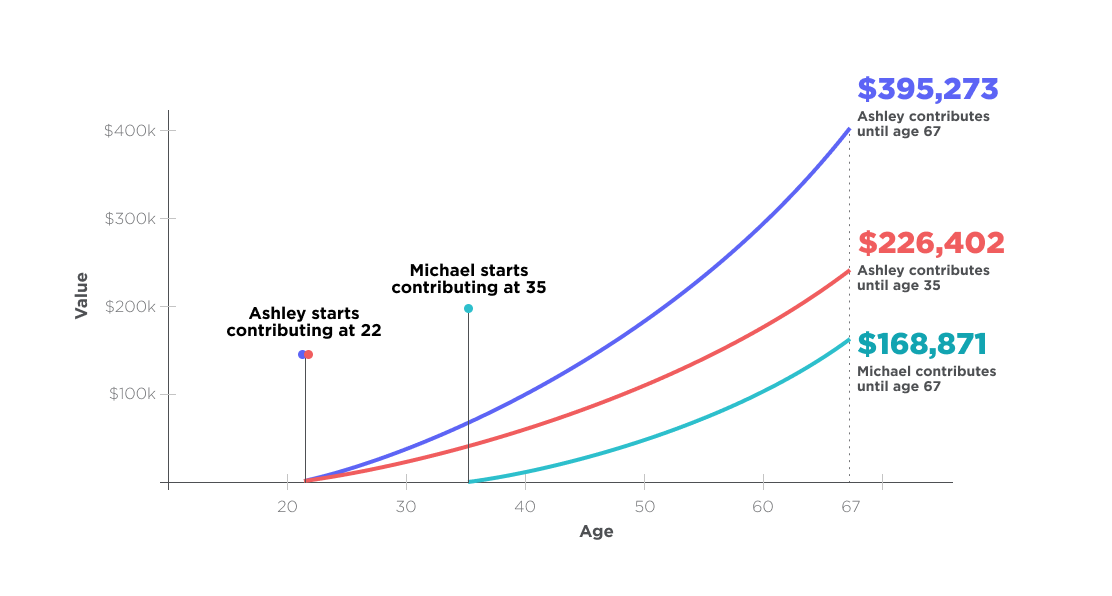

Ashley and Michael are both 22 and earn $35,000 a year. Ashley begins contributing $150 a month right away to her employer-sponsored retirement plan and continues for 13 years, until she stops at age 35. On the other hand, Michael puts off making contributions until he turns 35. Then, he contributes $150 monthly until he retires at age 67.

As the chart below shows, in our example, Michael ends up with $168,871, while Ashley has $226,402. That’s $57,531 less in retirement savings for Michael compared to Ashley, even though he contributed for 19 more years. Moreover, if Ashley were to continue contributing under the same 6% annual rate of return assumed for this scenario until age 67, her overall savings would be more than twice as much as Michael’s.

This hypothetical example is for illustrative purposes only and does not represent any actual investment performance, price or yield. This illustration assumes a beginning balance of $0 and a monthly retirement plan contribution of $150. The illustration uses an annual rate of return of 6%. Investment returns are not guaranteed, and your actual return may vary significantly from that shown. All investments involve risks, including possible loss of principal.

Bottom line? The sooner you begin contributing, the more time the power of tax-deferred compounding and contributions to your retirement plan have to help you meet your long-term financial goals.* Consider increasing your contribution amount annually until you are taking full advantage of any employer match, if offered. But don’t stop there if you don’t have to. Also consider going beyond the match, and continue to increase your contribution over time.

*Generally, withdrawals are subject to income tax at your ordinary income tax rate at the time of withdrawal, and if made prior to age 59 ½, a 10% federal tax penalty.